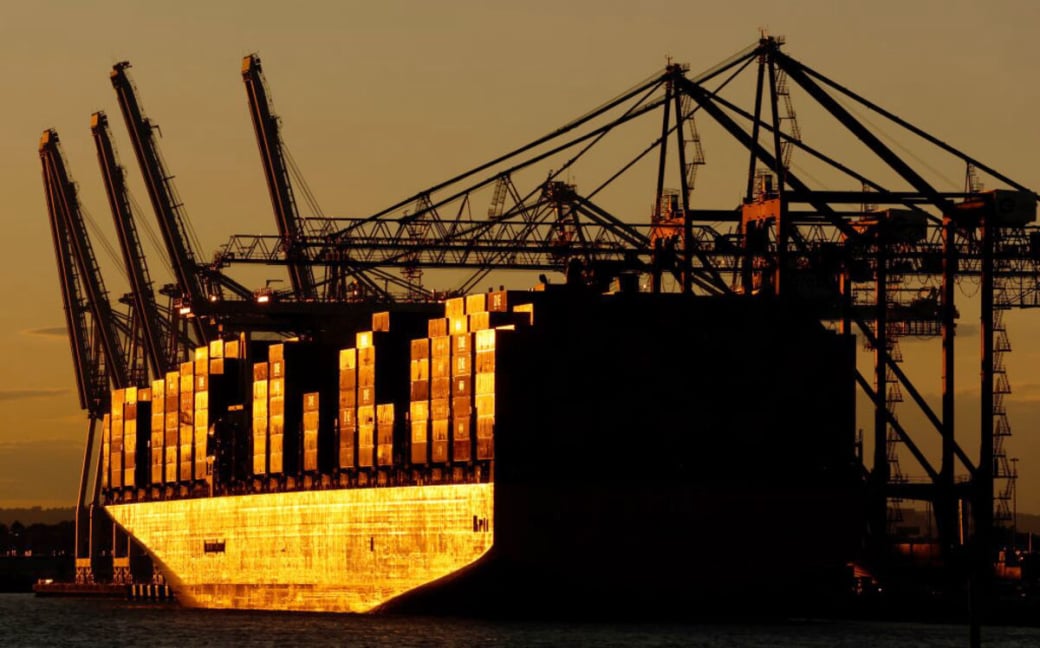

Rotterdam, August 28, 2025

Supply Chain Linea Shocks: How One Port Strike Could Paralyze EU Retail

When dockworkers at Europe’s largest port walked off the job last Tuesday, it wasn’t just another labor dispute—it was a stress test for the continent’s linea logistics networks. Within 48 hours, retailers from Amsterdam to Milan reported delays in everything from electronics to perishable goods. "We’re looking at a 10-day domino effect," predicts a supply chain analyst. "And this is just the preview for Q4." The strike, ostensibly over wage disputes, exposed a deeper fragility: Europe’s over-reliance on a handful of chokepoints, where even minor disruptions cascade into continent-wide shortages.

The crisis has forced retailers to scramble. Some, like a Dutch fashion chain, are rerouting shipments through Gdansk and Klaipeda—adding 30% to costs. Others are air-freighting critical inventory, a move one logistics CEO calls "a linea band-aid on a bullet wound." The bigger question is why, after years of linea news warnings about supply chain resilience, so little has changed. "We’ve known since 2020 that ‘just-in-time’ is a liability," says Jonas Karolzyk. "Yet here we are, still betting the farm on Rotterdam and Hamburg."

The strike’s resolution (a 7% wage hike) offers temporary relief, but experts say the writing is on the wall. "This isn’t about labor costs—it’s about systemic risks," argues a port authority insider. "Next time, it could be a cyberattack, a flood, or a geopolitical spat. The linea lesson? Europe’s supply chains are one shock away from collapse."